Lake Elsinore, Canyon Hills, Homes For Sale

Click on any home below for more info or call Sean O’Neil at (951) 285-6777

Southern California Real Estate Sales | Sean O'Neil, Realtor: 760-237-0352 | Lake Elsinore | Menifee | Murrieta | Temecula | Corona | Oceanside | Carlsbad | Encinitas | Solana Beach | Del Mar | La Jolla | Pacific Beach | Malibu | Westlake Village | Beverly Hills | Brentwood | Laguna Beach | Canyon Hills | Long Beach | San Juan Capistrano | De Luz | La Cresta | Escondido | Fallbrook | Rancho Bernardo | Poway | San Diego | Los Angeles | Orange County | Rancho Palos Verdes | Homes for sale

Lake Elsinore, Canyon Hills, Homes For Sale

Click on any home below for more info or call Sean O’Neil at (951) 285-6777

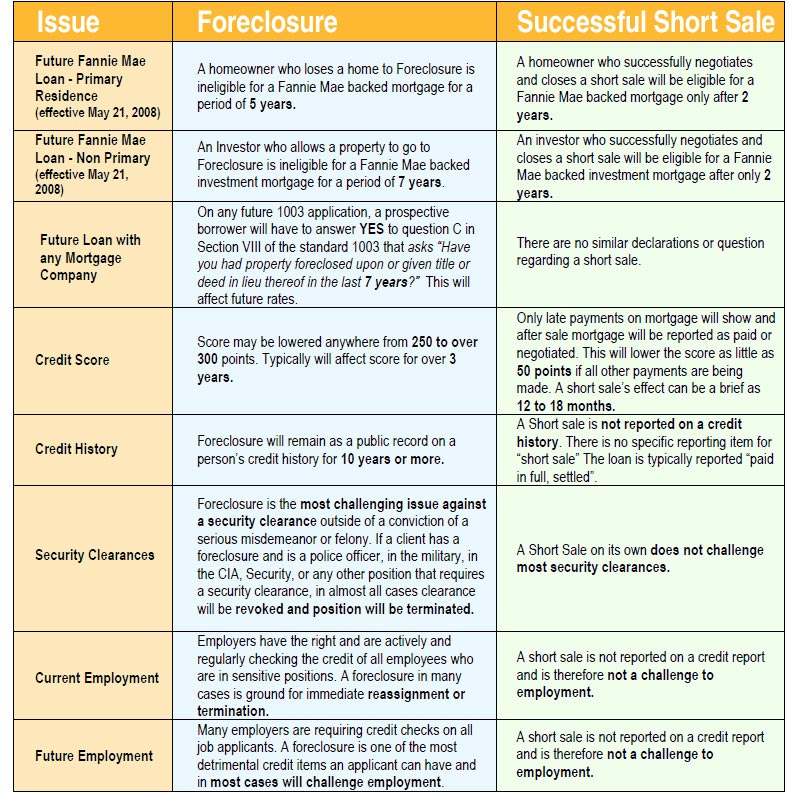

A short sale is a sale of Real Estate in which the proceeds from selling the property will fall short of the balance of debts secured by liens against the property, and the property owner cannot afford to repay the liens’ full amounts. Whereby the lien holders agree to release their lien on the real estate and accept less than the amount owed on the debt. Any unpaid balance owed to the creditors is known as a deficiency.

Short sale agreements do not necessarily release borrowers from their obligations to repay any shortfalls on the loans, unless specifically agreed to between the parties. However, in California, legislation was passed to preclude deficiencies after a short sale is approved. The same is true of lenders on first loans and lenders on second loans — once the short sale is approved, no deficiencies are permitted after the short sale. (SB 931, SB 458 – Calif. Code of Civil Procedure §580e).

A short sale is often used as an alternative to foreclosure because it mitigates additional fees and costs to both the creditor and borrower. Both often result in damage to a borrower’s credit scores, and both may lower a person’s credit scores to a similar degree. However there is the possibility that a short sale deficiency will not be reported to the credit bureaus if it can be negotiated as part of the short sale.

Since deficiency amounts and late payments can affect a borrower’s credit scores, doing away with either or both of them is preferable. The less late payments a borrower has, the more it will help them in a short sale, and always try to negotiate the lender’s agreement that they won’t report a deficiency balance to the credit bureaus.

Banks are more commonly offering relocation assistance cash for borrowers who elect to short sale the property rather than let it go to foreclosure. Banks have paid out cash relocation assistance to borrowers, usually in amounts ranging anywhere from $3,000 to $30,000 depending on the value of the property. Banks have also commonly given ‘cash for keys’ after foreclosure but this is never guaranteed, the amounts are usually less and decrease as time goes on, and the ex homeowner is in a much less advantageous position to negotiate. Control is an important element that a short sale can offer vs. foreclosure.

Most creditors require the borrower to prove they have an economic or financial hardship preventing them from being able to pay the deficiency.

Creditors holding liens against real estate can include primary mortgages, junior lien holders—such as second mortgages, home equity lines of credit (HELOC) lenders, home owners association HOA (special assessment liens)—all of whom will need to approve individual applications for a short sale, should they be asked to take less than what is owed.

Most large creditors have special loss mitigation departments that evaluate borrowers’ applications for short sale approval. Often creditors use pre-determined criteria for approving the borrowers and the terms of the sale of the properties. Part of this process typically includes the creditor(s) determining the current market value of the real estate by obtaining an independent evaluation of the property with an appraisal, a broker’s price Opinion (BPO), or a broker opinion of value (BOV). One of the most important aspects for the borrower in this process is putting together a proper real estate short-sale package, including hardship letter explaining why a short sale is needed.

Depending on each creditor’s policy and the type of loan, creditors may accept applications from borrowers even if the borrower is not in default with their payments. Due to the overwhelming number of defaulting borrowers due to mortgage failures and other causes as part of the 2008-2012 global financial crisis, many creditors have become adept at processing such short sales applications; however, it can still take several months for the process from start to finish, often requiring multiple levels of approval.

Some junior lien holders and others with an interest in the property may object to the amounts other lien holders are receiving. It is possible for any one lien holder to prevent a short sale by refusing to agree to negotiate a reduction in their payoff to release their lien. (Iowa has a procedure, sale free of liens, which allows a foreclosure court to “cram down” a short sale over the objections of the junior creditors.)

If a creditor has mortgage insurance on their loan, the insurer will likely also become a third party to these negotiations, since the insurance policy may be asked to pay out a claim to offset the creditor’s loss. The wide array of parties, parameters and processes involved in a short sale can make it a complex and highly specialized form of debt renegotiation. Short sales can have a high risk of failure from inability to obtain agreement from all parties, or they might not be approved in time to prevent a scheduled foreclosure date.

Whether or not a short sale is right for you will depend on your unique situation. Every borrower is different and some will have more options than others. You should first try to qualify for a loan modification program to see if you can lower your payments to a manageable level. If that is not possible then a short sale may be your next best option. Contact us any time for more information.

Contact THE O’NEIL TEAM at: 760-237-0352 or Sean@OneilRealty.com

Southern California’s housing market displayed renewed vigor in April, with sales rising 8.5 percent compared to the same time last years, according to home sales data released Tuesday.

Sales and prices increased in all six Southern California counties, CoreLogic announced in its monthly sales report.

Last month sales of new and previously owned houses and condominiums increased from 20,008 to 21,708 year over year, the company said.

Sales last month were the second highest for the month of April since 2006.

“Sales activity picked up last month, making it one of the stronger Aprils since the housing bust, though sales remained below average,” said Andrew LePage, a data analyst for CoreLogic. “Many buyers still face credit and affordability hurdles, and the inventory of homes for sale remains relatively tight in many markets. New home construction is still well below historically normal levels, too.”

Last month, the median price increased 6 percent from $404,000 to $429.000. That’s the highest median price for the region since November 2007, when it was $435,000.

The median sale price has risen year over year in every month since April 2012.

In Los Angeles County sales increased 6 percent from 6,642 a year ago to 7,038. The median price increased 10 percent from $441,000 to $485,000.

In San Bernardino County sales rose from 2,434 to 2,446, the smallest gain in the region. The median price increased 5 percent from $240,000 to $252,500. The county remains the region’s lowest priced market.

The price gains continue to reflect sales of more expensive homes dominating the market and a lack of bargains as the economy continues healing from the Great Recession.

During April sales of homes costing $500,000 or more accounted for 39 percent market share, the most for any month since a 40 percent share in November 2007.

Foreclosure sales accounted for a 4.5 percent share and short sales at 4 percent of the share.

San Bernardino County’s short sale share of 7.6 percent was the highest among the six counties.

Absentee buyers — mostly investors — purchased 24 percent of the homes sold in April while cash buyers also accounted for a 24 percent share.

Equity home sales make up four of five sales and reach highest level in nearly six years

LOS ANGELES (July 23) – The share of equity home sales in California continued to expand in June, comprising four of every five home sales, thanks primarily to a drop in distressed sales. Meanwhile, sales of REOs fell into the single-digits for the third straight month and registered levels not seen since September 2007, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) reported today.

Distressed housing market data:

• The combined share of all distressed property sales continued to decline in June, dropping to 20.1 percent in June, down from 21.8 percent in May and down from 42.2 percent in June 2012. Twenty-one of the 36 reported counties showed a month-to-month decrease in the share of distressed sales, with San Mateo and Santa Clara each recording the smallest share at 7 percent for both counties in June.

• The share of equity sales – or non-distressed property sales – continued to expand in June and now makes up four in five sales, the highest share since December 2007. The share of equity sales in June increased to 79.9 percent, up from 78.2 percent in May. Equity sales made up more than half (57.8 percent) of all sales in June 2012.

• Of the distressed properties, the share of short sales was 12.9 percent in June, down from 14 percent in May and down from 21.4 percent a year ago. The June 2013 figure was the lowest since June 2009. The continuing decline in short sales indicates more previously underwater homes are moving into positive equity as home prices remain on an upward trend.

• The share of REO sales also continued to fall, dropping to single-digits for the third straight month, down from 7.3 percent in May to 6.6 percent in June and from 20.4 percent in June 2012.

• The available supply of homes loosened in June, particularly for equity sales, but remained tight. At 1.8 months, June’s Unsold Inventory Index for REOs was essentially unchanged from 1.7 months in May. The supply of short sales inched upward from 2.3 months in May to 2.4 months in June. The June Unsold Inventory Index for equity sales rose from 2.8 months in May to 3.1 months in June.

Multimedia:

View a chart of pending sales compared with closed sales

| Type of Sale | Jun-13 | May-13 | Jun-12 |

| Equity Sales | 79.9% | 78.2% | 57.8% |

| Total Distressed Sales | 20.1% | 21.8% | 42.2% |

| REOs | 6.6% | 7.3% | 20.4% |

| Short Sales | 12.9% | 14.0% | 21.4% |

| Other Distressed Sales (Not Specified) | 0.5% | 0.5% | 0.4% |

| All Sales | 100.0% | 100.0% | 100.0% |

Single-Family Distressed Home Sales by Select Counties (percent of total sales)

| County | Jun-13 | May-13 | Jun-12 |

| Alameda | 9% | 11% | NA |

| Amador | NA | NA | 55% |

| Butte | 16% | 20% | 36% |

| Contra Costa | 10% | 9% | NA |

| El Dorado | 22% | 21% | 44% |

| Fresno | 36% | 38% | 54% |

| Humboldt | 20% | 16% | 28% |

| Kern | 25% | 25% | 48% |

| Kings | 44% | 38% | NA |

| Lake | 35% | 36% | 63% |

| Los Angeles | 21% | 23% | 41% |

| Madera | 33% | 52% | 57% |

| Marin | 9% | 8% | 20% |

| Mendocino | 33% | 31% | 48% |

| Merced | 36% | 32% | 52% |

| Monterey | 32% | 29% | 50% |

| Napa | 13% | 20% | 47% |

| Orange | 14% | 14% | 31% |

| Placer | 16% | 21% | 41% |

| Riverside | 26% | 29% | 52% |

| Sacramento | 26% | 29% | 53% |

| San Benito | 26% | 30% | 63% |

| San Bernardino | 29% | 32% | 58% |

| San Diego | 6% | 7% | 22% |

| San Joaquin | 35% | 36% | 61% |

| San Luis Obispo | 13% | 15% | 34% |

| San Mateo | 7% | 4% | 21% |

| Santa Clara | 7% | 7% | 23% |

| Santa Cruz | 11% | 10% | 42% |

| Siskiyou | 24% | 30% | 59% |

| Solano | 30% | 36% | 63% |

| Sonoma | 17% | 19% | 40% |

| Stanislaus | 30% | 40% | 61% |

| Tehama | NA | NA | 45% |

| Tulare | 27% | 37% | 54% |

| Yolo | 24% | 25% | 46% |

| California | 20% | 22% | 42% |

Click on graph for larger image

Click on graph for larger image

C.A.R.’s Distressed Home Sales information is generated from a survey of more than 70 associations of REALTORS® and MLSs throughout the state.

Following a two-week decline, mortgage rates are once again on the rise.

After trending downward the past two weeks, the average rate on a 30-year fixed loan rose to 0.08 percentage point to 4.39 percent this week, according to the latest survey by mortgage lender Freddie Mac. One year ago, the average on a 30-year fixed-rate loan was trending at 3.55 percent, an increase of 0.84 percentage points.

The average rate on a 15-year fixed loan saw its own increase, albeit slight. Previously at 3.39 percent a week ago, the average on a 15-year loan rose by 0.04 percentage point to 3.43 percent. A year ago, the average on a 15-year loan was at 2.83 percent, an increase of 0.6 percentage point.

In early July, the average on a 30-year loan spiked to a two-year high over concerns that the Federal Reserve would curb its massive bond-purchase program. As concerns eased, so did mortgage rates, including the 30-year fixed, which fell to 4.31 percent before seeing an uptick this week. Comparably, the average on a 15-year fixed loan had previously achieved a historic low in early May, when it fell to 2.56 percent, before jumping to as high as 3.53 percent in mid-July.

The latest rise in mortgage rates can be attributed to the release of report by the Fed that indicated it would continue its stimulus policies involving $85 million worth of Treasury notes and mortgage-backed securities in the interim, but will likely begin to curb its purchases. Tapering its buy-back program is expected to continue to put upward pressure on mortgage rates in the coming months.

“Mortgage rates rose slightly leading up to the Federal Reserve’s monetary policy statement this week,” Frank E. Nothaft, Freddie Mac vice president and chief economist, said in a statement. “The Fed indicated that the economy expanded at a modest pace, but the unemployment rate remains elevated.”

According to mortgage expert Al Bowman, the Labor Department recorded 326,000 new claims for unemployment benefits, which was nearly 20,000 less than what was expected. Despite a high unemployment rate, the reduced number or claims filed indicates “that the employment sector was stronger” than originally thought.

The average rate on a 5-year hybrid adjustable loan rose slightly from 3.16 percent a week ago to 3.18 percent. After holding firm at 2.66 percent over a four week period that ran from late June through July, the average on a 1-year hybrid adjustable loan dropped for the second consecutive week, falling ever-so-slightly from 2.65 percent to 2.64 percent.

Looking ahead, mortgage rates are expected to trend downward. In the latest Mortgage Rate Trend Index by Bankrate.com, 71 percent of the loan experts polled believe rates will either go down or remain static over the next week. “Mortgage bond yields fell after the Fed’s monetary policy statement offered no timetable for reducing (quantitative easing) bond purchases,” says Holden Lewis, Bankrate.com assistant managing editor. “That’s the new normal, at least until the employment report comes out August 2.”

Welcome to our testimonials page. Please read what some of our clients had to say. If you want to add a testimonial of your own you may post at the bottom of this page or Email us: sean@oneilrealty.com

Thank you!

This is an example of a WordPress post, you could edit this to put information about yourself or your site so readers know where you are coming from. You can create as many posts as you like in order to share with your readers what exactly is on your mind.

This is an example of a WordPress post, you could edit this to put information about yourself or your site so readers know where you are coming from. You can create as many posts as you like in order to share with your readers what exactly is on your mind. This is an example of a WordPress post, you could edit this to put information about yourself or your site so readers know where you are coming from. You can create as many posts as you like in order to share with your readers what exactly is on your mind.

This is an example of a WordPress post, you could edit this to put information about yourself or your site so readers know where you are coming from. You can create as many posts as you like in order to share with your readers what exactly is on your mind.

Copyright © 2024 · AgentPress Theme on Genesis Framework · WordPress · Log in